Top 5 free accounting software for self-employed professionals

Published on 03/05/2023 Written by Smriti Arya.

Whether you are a self-employed person or running a small firm, you may need accounting software to handle the financial operations and have a clear understanding of the profitability of your business. With this in mind, we have created a list of the top five free accounting software for self-employed people or small businesses.

In this article

Accounting software is designed for businesses to help them track their invoices and expenses and manage financial records. If you are about to set up your business, you might look for free accounting software to start with little to no expenditure.

In this context, this article lists the top five free accounting software for small businesses that self-employed professionals can use to tackle some of their workloads.

The software listed below are arranged in alphabetical order and have been selected based on the following factors:

- Products that have at least 20 user reviews over the last two years from April 2021 - April 2023

- Have an overall rating of at least 4/5 stars by users

- Products that meet Software Advice’s market definition and core features of accounting software, offering a free version

The full methodology for selecting these tools can be found at the bottom of the article.

- Overall rating: 4.6/5

- Value for money: 4.7/5

- Functionality: 4.2/5

- Ease of use: 4.8/5

- Customer support: 4.6/5

Momenteo is a cloud-based accounting platform designed for self-employed professionals or freelancers to help them manage their clients and expenses and create and track invoices. With Momenteo’s financial reporting feature, users can keep a tab on their finances, including net profit, available funds, pending invoices and payments collected.

To verify the consistency of the financial data between two accounts, users may leverage the benefits of Momenteo’s bank reconciliation feature. This functionality gives them access to a complete report about all the income and expenses of a business that can be verified with bank account records. Using its billing/invoicing functionality, teams can create and send customized invoices to clients.

Momenteo’s tax management feature allows users to manage and automate tax-related operations, such as preparing tax return forms, creating a tax summary and tracking due taxes. The software supports multiple currencies by allowing self-employed professionals to send invoices and quotes in different currencies.

The tool has a free version that provides accounting services for 2 active clients. In case a user wants to offer services to more than 2 clients, they can opt for other paid plans based on their requirements. More information on the pricing can be found on their website.

2. Open

- Overall rating: 4.7/5

- Value for money: 4.9/5

- Functionality: 4.5/5

- Ease of use: 4.7/5

- Customer support: 4.7/5

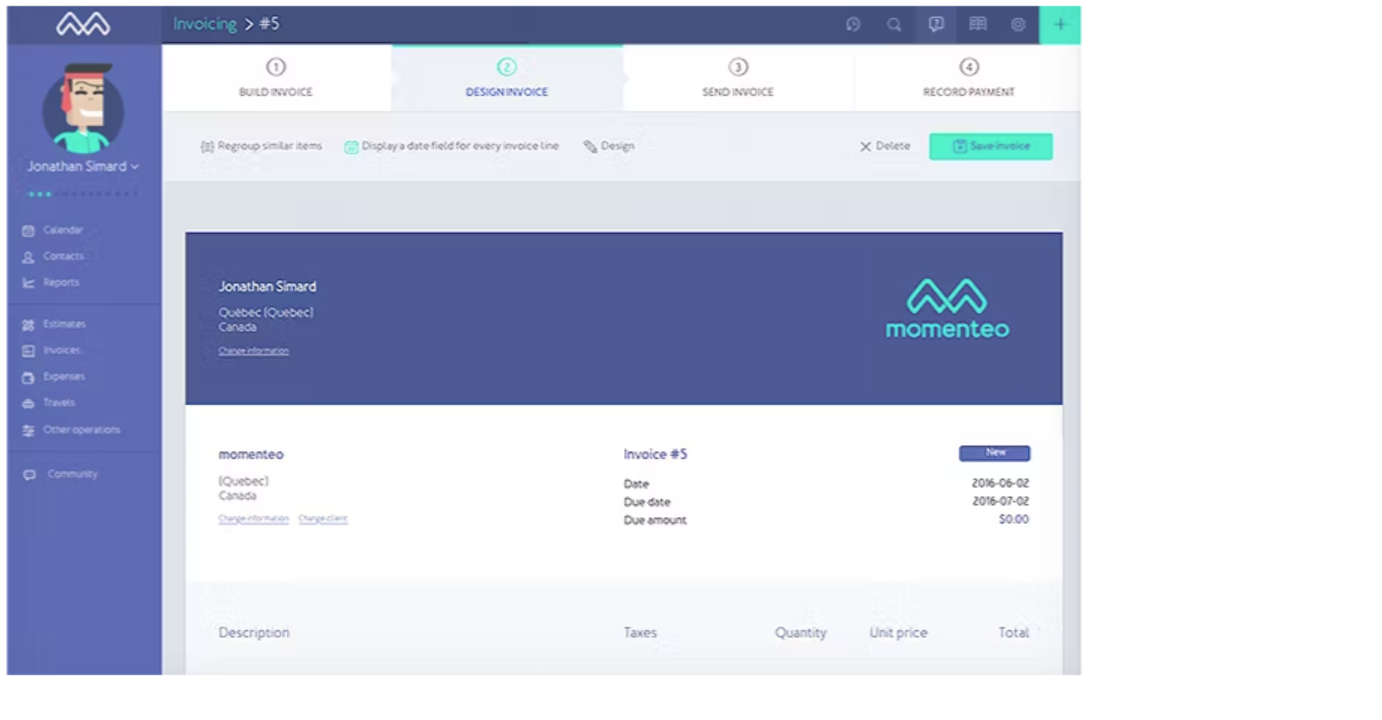

Open is a cloud-based accounting automation solution that helps self-employed workers and small to medium businesses manage invoices, payments, expenses and other finance operations via a unified platform. Using its billing/invoicing functionality, users can generate regulatory-compliant invoices, collect payments and send automated notifications for outstanding invoices.

Self-employed professionals can benefit from the insightful financial reports generated by Open accounting software that entail profit and loss reports and smart cash flow of funds. This tool also comes with auto-reconciliation capabilities, allowing users to match all their cash flow against their bank accounts.

The software’s free version is suitable for professionals who are just setting up their business. To get information related to the pricing, users can visit their official website.

Read more

- Overall rating: 4.4/5

- Value for money: 4.5/5

- Functionality: 4.2/5

- Ease of use: 4.5/5

- Customer support: 4.2/5

ProfitBooks is an online accounting software for small businesses and self-employed professionals that lets users create customized invoices, track outstanding payments and receive payments via a payment gateway. The software’s billing/invoicing feature allows users to create invoices, get paid faster and track any due invoices.

In order to understand the financial status of a business, users can view financial reports via ProfitBooks software and check the net profit, the loss incurred, overdue payments and receivables. Utilizing the bank reconciliation feature, it is also possible to verify the accuracy of entries recorded in the books of the accounts, thereby minimizing cash manipulations and frauds.

Its tax management feature enables self-employed individuals to generate detailed tax reports and manage tax compliance so that they can file taxes on time. The tool also supports multiple currencies by allowing users to create invoices and make transactions in different currencies.

ProfitBooks’s free version allows businesses to create up to 25 invoices per month and manage up to 100 customers; however, they can upgrade to their paid plans in order to fulfil their requirements. More information on their paid plans can be checked on their official website.

- Overall rating: 4.6/5

- Value for money: 4.5/5

- Functionality: 4.5/5

- Ease of use: 4.6/5

- Customer support: 4.5/5

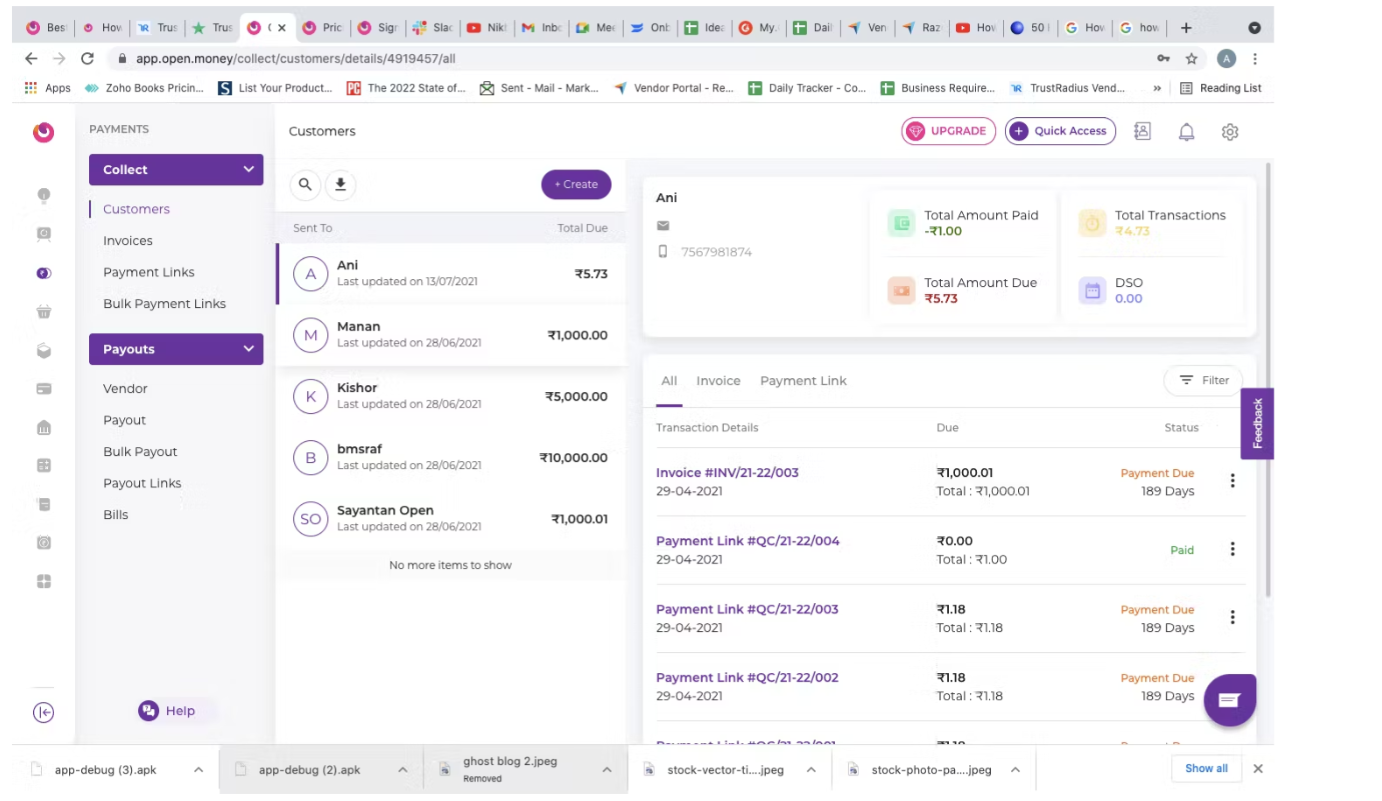

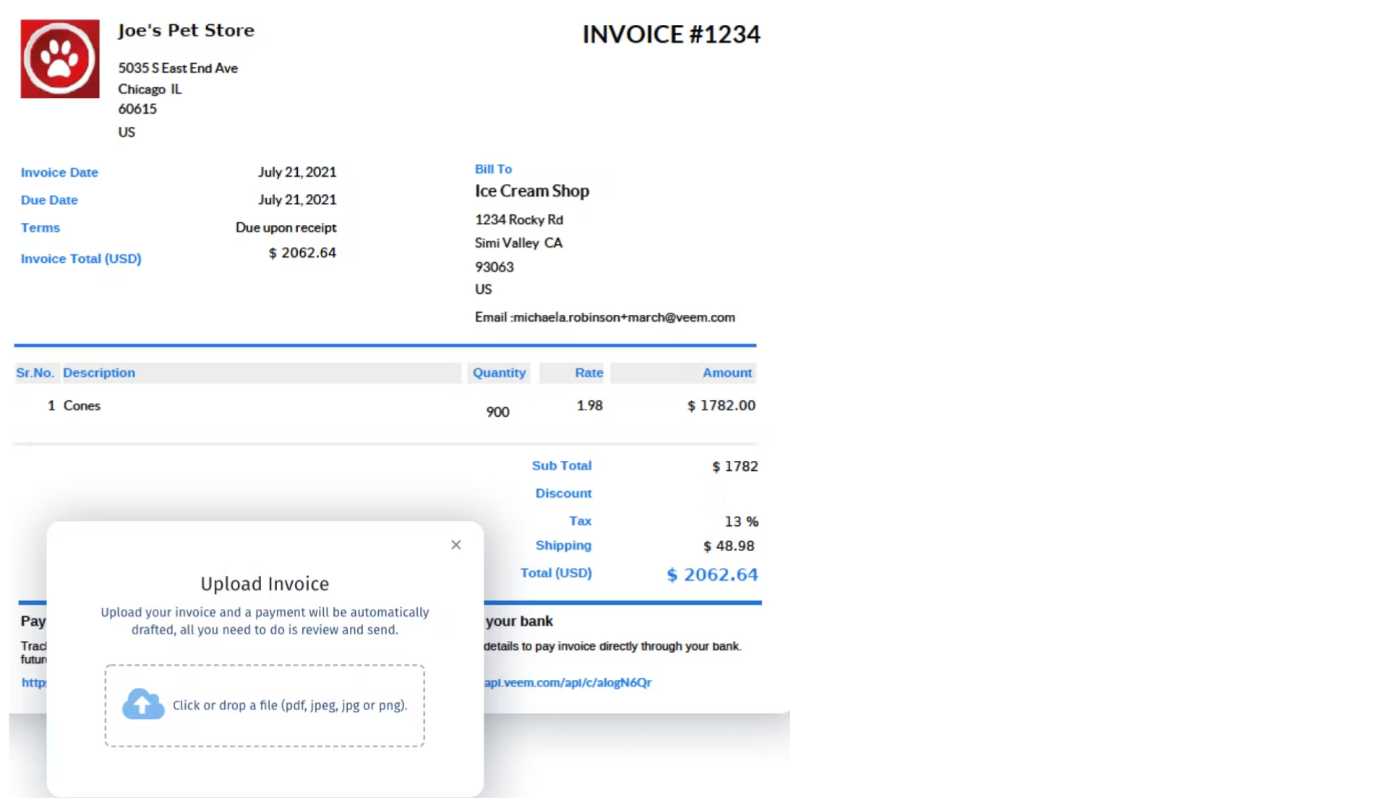

Veem is accounting software that helps users empower their accounting practices by enabling global transaction management and automating clients’ payables and receivables. The software also allows businesses to create digital invoices and send them to clients via payment request email or a secure pay link.

Moreover, users can keep a tab on their cash flow by verifying the cash flow in accounting records against their bank records using bank reconciliation functionality. Self-employed individuals or small businesses may use Veem’s financial reporting feature to get a clear view of all the payments received and made and gain insights on outstanding invoices.

By supporting multiple currencies, Veem accounting software allows clients to pay invoices in their local currency and receive the payment a user requested in a different currency. The product’s free version provides individuals or businesses with the ability to manage payables and receivables. To know more about their paid or free plans, visit their official website.

5. Zoho Books

- Overall rating: 4.4/5

- Ease of use: 4.4/5

- Functionality: 4.2/5

- Ease of use: 4.3/5

- Customer support: 4.2/5

Zoho Books is designed for businesses and self-employed individuals to help them manage and automate their finances and business workflows. From profit and loss statements to cash flow statements, tax summaries and invoice reports, Zoho Books allows users to get a detailed overview of their financial reports.

The software’s invoicing/billing feature lets businesses create customized invoices and set up reminders for their clients so they don’t have to repeatedly follow up on a payment. Using this software, users can also reconcile their accounts to ensure that their transactions in the bank match the transactions they have created in Zoho Books. Doing this may help them track cash frauds or manipulations.

The product’s tax management functionality includes country-specific taxes, tax groups and multiple tax rates that users may set up based on their business’s requirements. With its advanced multi-currency handling feature, businesses or self-employed workers can manage payments in different currencies.

The software’s free version offers various features but with restricted usage. However, users can upgrade to paid plans based on their needs and requirements as their business grows. More details related to the pricing plans can be found on their website.

Read more

Methodology

- To select the tools for this list, we identified the top free products for “accounting software,” which offer a free version of the software.

- The shortlisted products were then assessed against the market definition of accounting software: accounting software automates an organization's financial functions and transactions with modules including accounts payable, accounts receivable, payroll, billing, and general ledger. Integration of accounting applications allows for comprehensive, real-time, and on-demand analysis of an organization's financial status.

- All the above software have the following core features: accounts payable, accounts receivable, bank reconciliation, financial reporting and general ledger.

- Besides that, the tools were further checked against the following criteria: average overall ratings above 4/5 stars, minimum 20 user reviews over the past two years (28th April 2021 – 28th April 2023).

This article may refer to products, programs or services that are not available in your country, or that may be restricted under the laws or regulations of your country. We suggest that you consult the software provider directly for information regarding product availability and compliance with local laws.