LendingFront

About LendingFront

LendingFront pricing

LendingFront does not have a free version. LendingFront paid version starts at US$5,000.00/month.

Alternatives to LendingFront

All LendingFront Reviews Apply filters

Browse LendingFront Reviews

All LendingFront Reviews Apply filters

This service may contain translations provided by google. Google disclaims all warranties related to the translations, express or implied, including any warranties of accuracy, reliability, and any implied warranties of merchantability, fitness for a particular purpose and noninfringement. Gartner's use of this provider is for operational purposes and does not constitute an endorsement of its products or services.

- Industry: Computer Software

- Company size: 201–500 Employees

- Used Daily for 1+ year

-

Review Source

Show more details

Reporting capabilities & Support received is first class.

The LendingFront Team is dedicated to providing a tailor made solution & first class customer support. Any request we make is handled efficiently, we have had no declines to any of our feature requests. The application is intuitive and smart, the support team feels an additional team member.

Pros

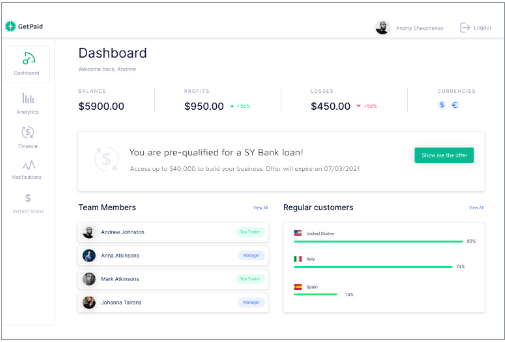

LendingFront has allowed us to grow and manage our Capital Program, its reporting capabilities allow us to make decisions. The dashboard provides a full real-time 360 view of the program. The Dashboard and Reporting features allow us to group and target specific merchants, even identifying and helping us take action to mitigate risk. We need to work quickly and without interruption so the fact there is no delay when adding or changing records allows us to report accurately.

Cons

Initially we had to request the LendingFront Team make changes once we entered data, but we requested to have this access ourselves, which we received.