Brand loyalty in the UK: What do consumers really think?

Published on 03/01/2023 Written by David Jani.

In part one of this two-part series, we explored customer loyalty programs and how customers felt about them. In this article, we will explore what drives customer loyalty towards brands more generally.

In this article

There’s a maxim in business that it’s more expensive to acquire new customers than it is to sell to your current ones. But in an age where competitors are only a click away, how can brands keep their existing clientele happy so they keep coming back for more?

We surveyed 1,000 UK consumers in November 2022 to help small to midsize enterprises (SMEs) understand what customer loyalty really means today. In part one, we focused on how people in the UK view customer loyalty programmes and how the cost-of-living crisis drives interest in them. Here, we explore consumer attitudes to brand loyalty more generally and ask what tools SMEs can use to retain their customers.

You can scroll to the bottom of this post for a full methodology of the study.

Key learnings:

- What makes customers loyal to brands and inspires repeat purchases

- Factors that influence customers to try new brands

- Product/service sectors that have the most loyal customers

Consumers have their eyes open to new brands

Despite its name, the concept of customer loyalty is not a particularly customer-centric one. Brands tend to care about it because it means repeated interactions with a known buyer, which can lead to more purchases in the long run. But customers don’t view themselves as a source of potential income for brands. Their main concern is getting the goods and services they need (or want) at a fair price and without too much hassle.

It’s no surprise, therefore, that most of the consumers in our survey are happy to look at buying from new brands. 58% of respondents say they are very open to trying new brands, and 42% say they are somewhat open to it, while less than 1% say they’re not open to it at all.

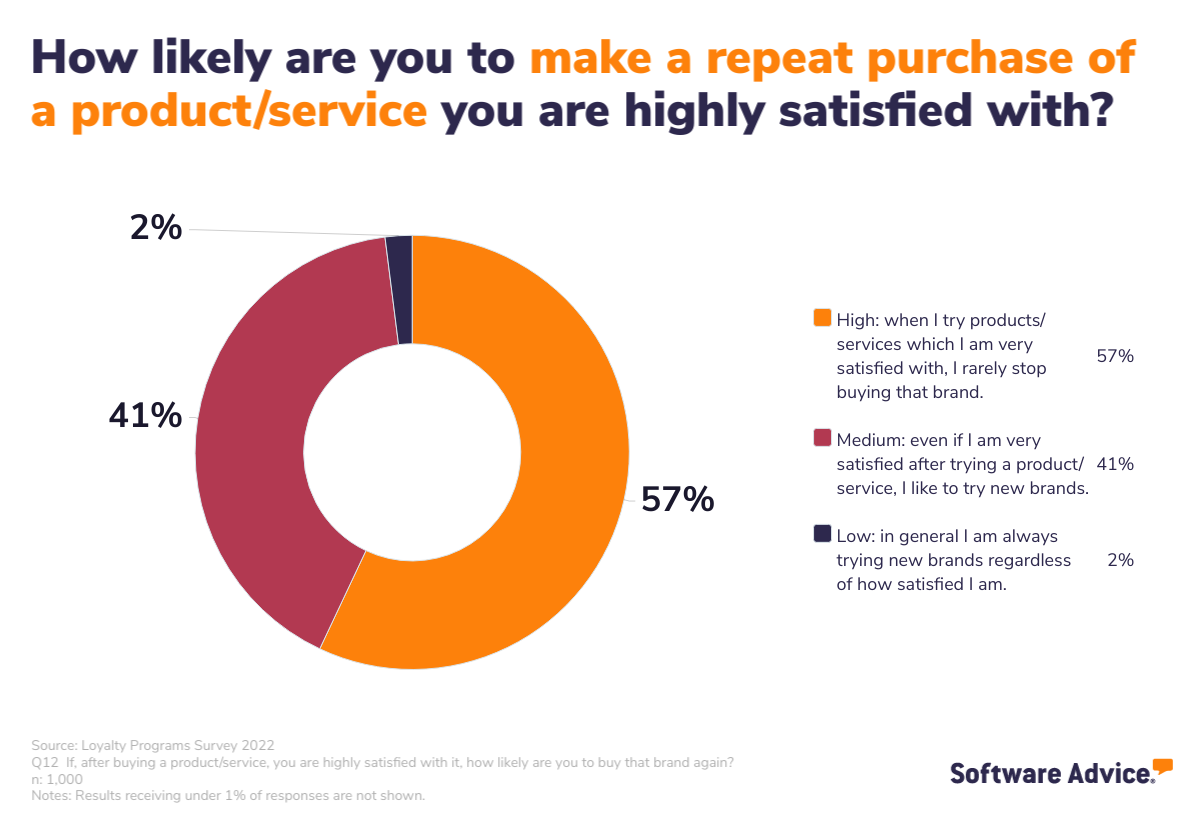

Moreover, 43% of the UK consumers we spoke to said they like to try new brands even when they are satisfied with the goods and services they’re currently getting. When asked how likely they would be to buy from a brand again —even if they were highly satisfied with its products or services— 41% rated that likelihood as medium and 2% as low.

With this in mind, no company can count on customers to keep coming back just for the sake of it. They need to understand what customers really value and what makes their brand or business ‘sticky’.

Age-old values of price and quality are biggest factors in customer loyalty

Any brand would love to have its customers stick around, and many marketing consultants make a good living out of advising companies on how to encourage repeat buyers. But the reality is always complex. Not only do brands have to consider what keeps customers loyal, they must also consider what might drive customers away and what competitors might do to attract them.

One simple factor stood out consistently in our survey: value for money.

First, when we asked respondents to tell us how important various brand characteristics are for building loyalty, the basics of quality and price came out on top. 76% said value for money was very important, and 62% said the same about the quality of a brand’s products or services over time. The least important factors related to communication. 54% said a brand’s presence on social networks was not at all important, and 44% said the same about its external comms, such as a newsletter or blog.

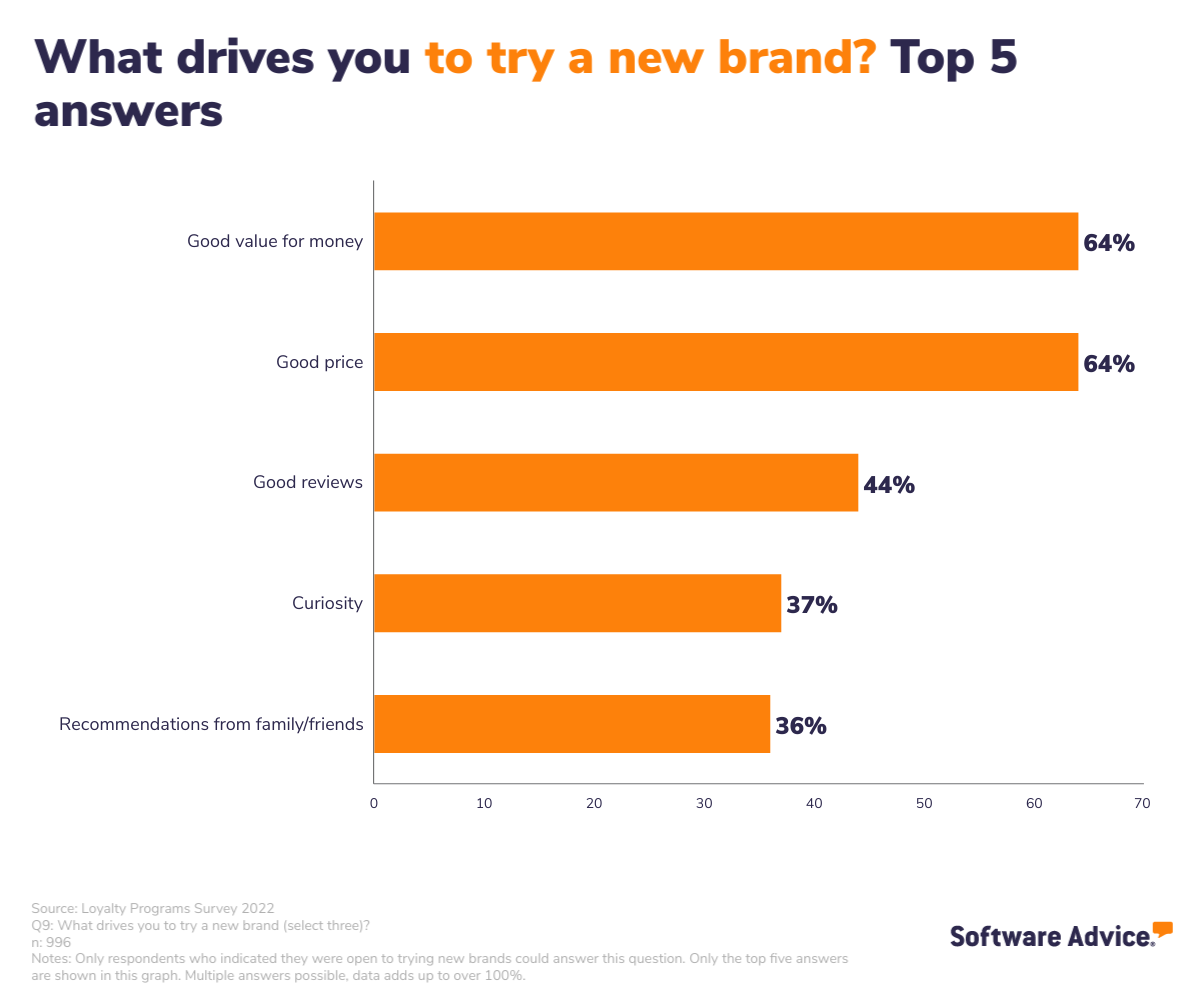

Similarly, the biggest driver to switching suppliers, for UK consumers, is price. When asked to state three factors that would encourage them to try a new brand, 64% each chose a good price or good value for money, far ahead of the next most selected responses, good reviews (44%) and curiosity (37%).

Reflecting this emphasis on price and quality, consumers in the UK told us that a dip in quality (cited by 56%) or an increase in cost (50%) would be most likely to drive them away from a brand — at least in theory. A bad experience with the product or service would also be a reason to leave for 46%.

In practice, it is rising prices that are by far the most likely factor to drive customers away. Of the 19% in our survey who said they stopped buying from a brand in 2022, most (70%) said it was because of price increases. None of the other response options attracted more than 20%, with the exception of reduction in quality, selected by 25%.

The message for SMEs here is clear. The balance between price and quality needs to be right to attract and retain customers. Getting this right first is fundamental to building a loyal customer base.

Word of mouth still has clout with consumers

After price and quality, it is interesting to note how much consumers value testimonials from other buyers. When looking at new brands, good reviews was the third most popular option, and recommendations from family/friends are also high on the list.

And despite consumers’ willingness to switch to new suppliers, they do feel a need to express their loyalty when they do like a brand. Three-quarters of the UK consumers we surveyed (74%) said that they would recommend a favoured brand to friends or family and 42% said they would write good reviews. Given that 56% of UK SMEs say that reviews are ‘very valuable’, brands should encourage happy customers to share their experiences by making it easy and, potentially, rewarding.

Although communication was low down on the list for consumers as a factor in customer loyalty, 74% said they would be happy to receive a newsletter or email communications from their favourite brands. Among those who would sign up, most wanted to see offers of some kind, either personalised (74%) or general offers (also 74%). Other types of content, like news about the brand or its industry were much less popular.

UK consumers ambivalent about brand loyalty across categories

Customer loyalty is not a single, inflexible quantity. Different types of businesses sell different types of products and services at different price points with vastly different purchasing experiences. It’s no surprise, then, that customers have different attitudes to loyalty when buying a chocolate bar compared to buying life insurance, for example.

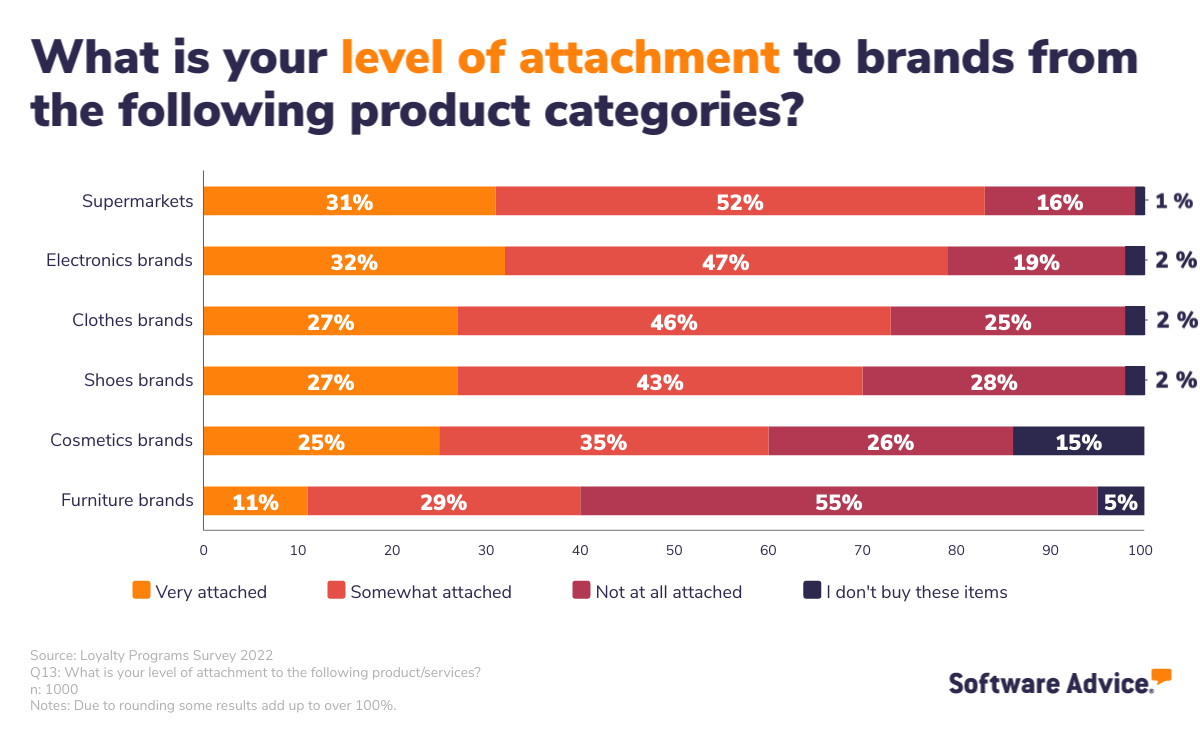

We asked respondents in our survey to rate their level of attachment towards brands in various product categories. Consumers tend to describe themselves as moderately attached to brands, with roughly one-quarter to one-third saying they are ‘very attached’ to brands in most categories. Notable exceptions here are where consumers have low attachment rather than high. For the furniture category, respondents tended to describe themselves as ‘not at all attached’ to brands.

This goes to further reinforce the fact that most consumers are, at best, only somewhat fond of the brands they buy from, even in areas that can inspire devoted followings like electronics and fashion.

Customers generally happy to share data for better services

As our survey shows, the way brands interact with their customers and vice-versa can have an effect on loyalty. This might not be as significant as the price/performance balance, but in industries where companies struggle to differentiate on price or quality (like electronics retailers selling the same items as competitors), brands have to look at the overall customer experience to stand out.

Personalisation offers a great way to do this, and many SMEs already personalise their services without realising. Coffee shops, bars, hairdressers and small shops know their regular customers and make sure they feel valued. This might mean discounts or unofficial freebies, but it could just be friendly chat or having your order ready for a certain time each day.

The technology for personalisation has advanced a lot in the past few years, so online businesses can now tailor their communications and offers to customers that they know well. But building up this knowledge means collecting data from customers, which requires trust. Nearly 7 in 10 of the UK consumers in our survey said they were willing to hand over some of their personal information so that brands can offer a personalised experience.

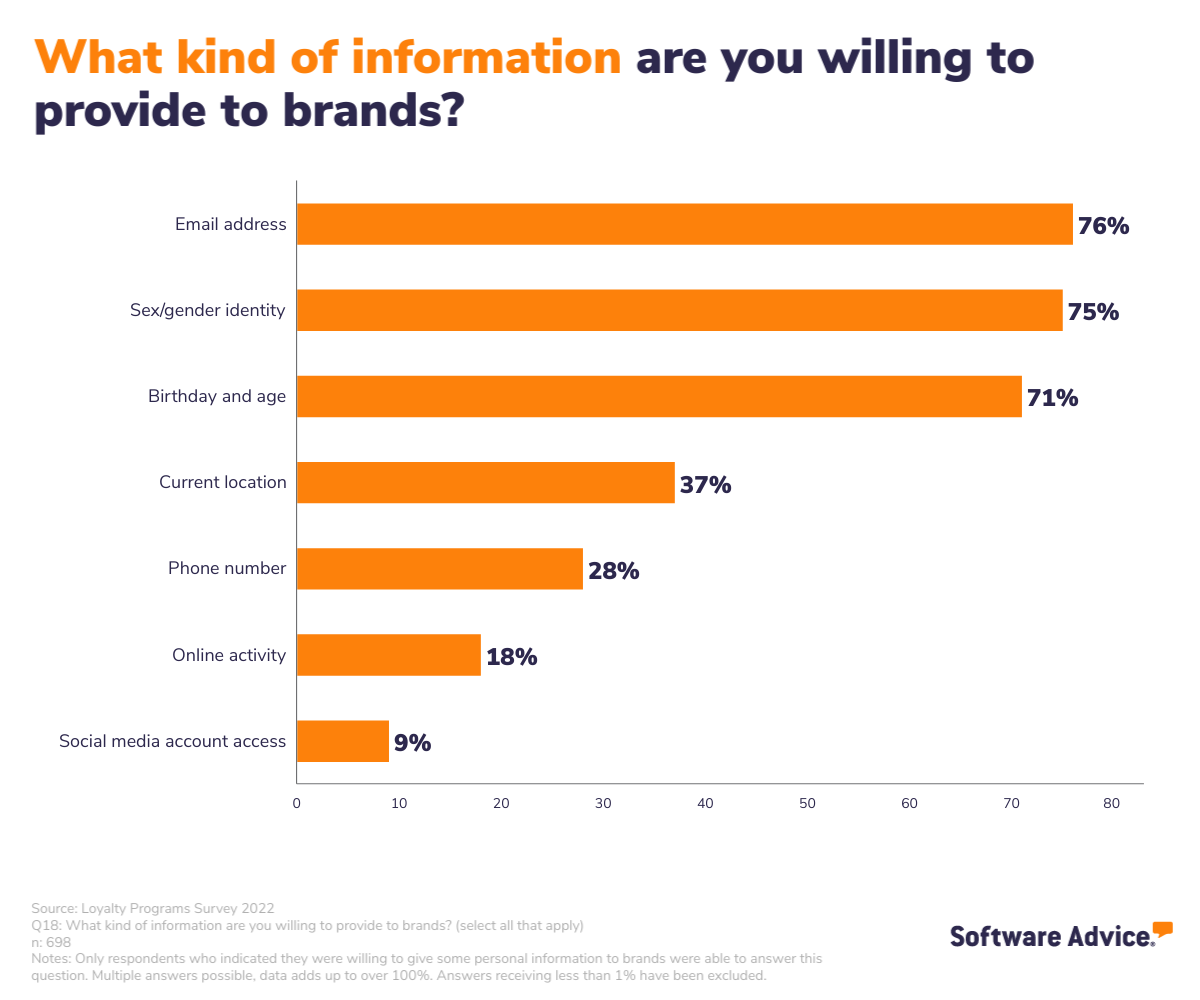

But some types of data are more precious to consumers than others. Of those who are willing to share personal data, around three quarters are happy to provide an email address (76%), their birthday and age (71%), and the sex/gender identity (75%) for personalization reasons. Perhaps they feel that giving this information will ensure they don’t get offers that are wildly inappropriate— teenagers probably don’t want adverts for funeral plans, for example, and retired men are unlikely to open emails offering discounts on eyelash treatments. However, the people in our survey were much less comfortable giving access to social media account data or online activity, suggesting that behavioural tracking is too high a price to pay for a personalised experience.

Mobile apps offer another easy way for customers to interact with brands. They also provide companies with a handy route to personalisation by gathering data to inform decisions about how to communicate with customers. 75% of customers said they would download an app from their favourite brands, with the most popular feature being loyalty programmes, where customers can earn points for purchases. 78% of those who showed interest in apps said they would like to see these, while 69% wanted in-app purchases and 54% wanted customer support features, such as a chatbot.

In summary

Our survey has revealed some key takeaways for SMEs in the UK that would like to increase customer loyalty.

- UK consumers are very happy to try new vendors and do not show high levels of attachment to brands in any category.

- Price and quality are the most likely factors to turn their heads and also the best ways to keep them loyal.

- Good reviews are also persuasive in getting customers to try a new brand, and happy customers are willing to provide recommendations.

- Most UK consumers take part in loyalty programmes, with 90% of those being a member of supermarket schemes.

- The biggest attractions to loyalty programmes are financial, with consumers looking for discounts and rewards.

- Customers like personalised services and offers and are willing to part with some data so that brands can deliver these.

Methodology:

Data for Software Advice’s Loyalty Program Survey 2022 was collected in November 2022. Results comprise responses from 1,000 UK participants. The criteria to be selected for this study are as follows:

- UK residents

- Aged 18 or older

This article may refer to products, programs or services that are not available in your country, or that may be restricted under the laws or regulations of your country. We suggest that you consult the software provider directly for information regarding product availability and compliance with local laws.