What our 2022 findings revealed about consumer data privacy concerns

Published on 23/11/2022 Written by David Jani.

Data is the secret weapon of an online business, but the more data is collected, the more consumer privacy concerns grow. When companies handle their data governance, it’s essential to understand consumer attitudes and manage expectations. However, is UK business doing enough to address the public's concerns?

In this article

Consumers want to guarantee their data protection, and privacy is well-guarded for many reasons. From online scams to identity theft, numerous threats can arise from poor data security or lax handling.

To learn more about these security concerns and what small-to-medium enterprises (SMEs) can do to avoid worrying their customers, Software Advice has revisited numerous surveys conducted this year to observe crucial patterns in how consumers feel about their data and its privacy.

In this article, we’ve looked back at these findings and collated the relevant results to see what they can teach us about how the British public feels about companies and their data collection practices. As the collection and use of customer data increases, are more fears and concerns triggered?

This Software Advice Digital Consumer Trend article identifies 4 trends that are the result of a meta-analysis of multiple surveys commissioned by Software Advice and its affiliate companies. Our full methodology for the surveys featured can be found at the end of this article.

1. Users are willing to share data for valuable services

Checkoutless shopping is a new way of interacting with supermarkets and shops selling groceries. These do away with checkouts altogether, replacing them with apps, sensors, and a camera system that allows customers to simply pick up the items they want and leave. A bill is later calculated from the goods selected.

However, using a checkoutless shopping system requires a lot of sensitive user data to function correctly. Users need to download an app, create an online profile, and provide details such as their payment information to try it out. This could be a hard sell for consumers concerned about the integrity of their data.

The 2022 Checkoutless Shopping Survey set out to discover how smartphone users in the UK feel about this trade-off. As this burgeoning industry employs new technology, resistance to sharing user data could represent a significant barrier to its growth.

Nevertheless, a combined 70% of the whole sample was interested in trying checkoutless shopping. When these interested consumers were questioned about their personal data being tracked by companies for this purpose, some concerns arose.

Overall, consumer privacy concerns were prevalent. A combined 81% expressed some concern compared with 16% who weren’t concerned and 3% who weren’t sure.

Whilst over three-quarters of people only registered the lowest concerns, nearly a fifth of consumers who were interested in trying checkoutless shopping expressed high levels of worry. This suggests that a small but significant audience share is highly protective of its data and has significant anxieties about sharing it.

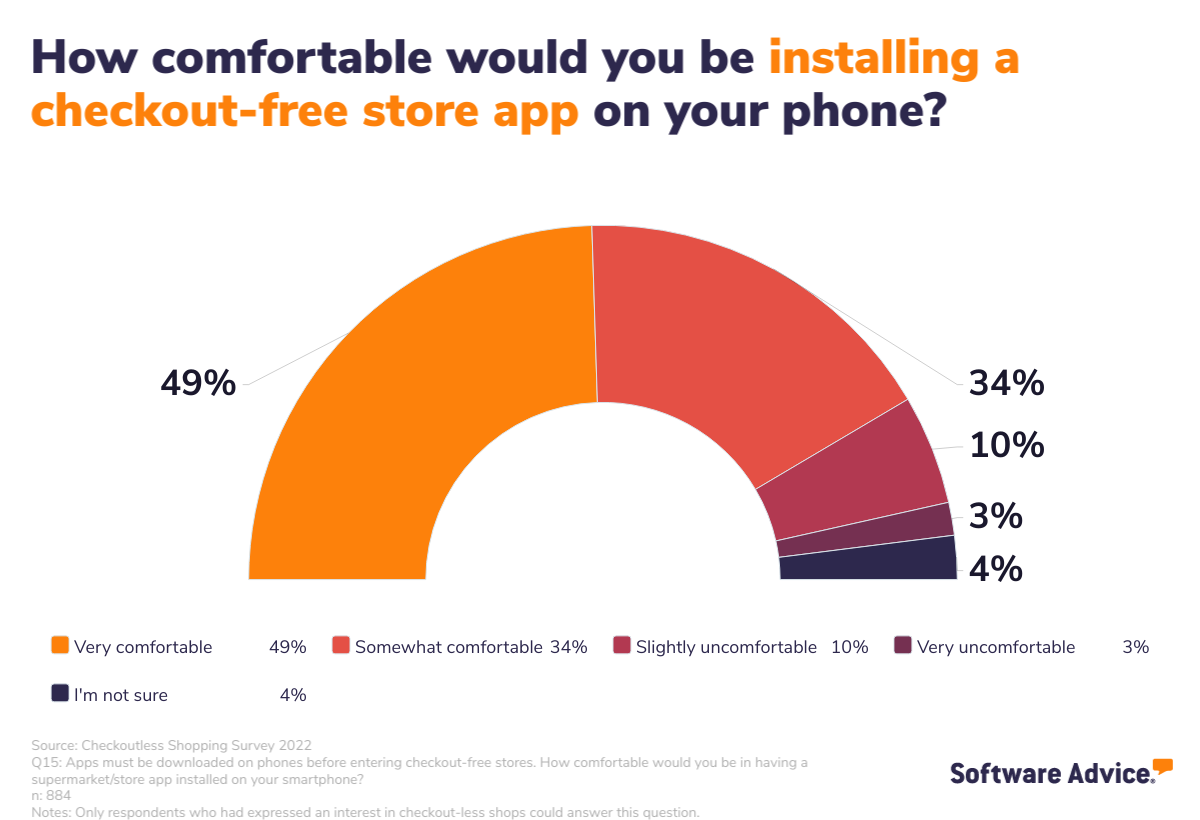

Despite this, there were still many people in this group of interested checkoutless shoppers who would accept installing an app for the service on their smartphones.

83% of those interested in using checkout-free stores would be comfortable installing a checkoutless shop app on their phone. From this it can be inferred that whilst fears exist, people are still willing to explore these new kinds of services.

Key takeaway

Despite the potential challenge of data privacy concerns, checkoutless shopping still generates strong interest with the majority of UK consumers.

The lesson businesses can take away from this look into checkout-free apps is that data is often freely given by consumers, but a level of concern must always be taken into account. Companies should take steps to reassure customers where possible.

Tip for SMEs

To build consumer trust SMEs must ensure they commit to cybersecurity best practices so that any data stored is kept safe. This will reduce the chance of a breach and help faith in the service remain intact.

2. Saving credit card data is tolerable to most (but fears persist)

Research published in the last few years has described UK consumers as a nation of ‘super subscribers’. It estimates households have multiple accounts open at any one time and values the subscription economy at more than £300 million.

To learn more about this booming marketplace, and to discover the possible pain points for UK consumers, the 2022 Subscription Business Model Survey, examined how online shoppers interact with these services. The study particularly focused on services that provided regular deliveries of products and services (non-traditional services) rather than media streaming companies.

Subscription companies usually require users to provide their credit card information to pay for the ongoing service. This means customers will have to provide and save sensitive data such as their credit card number, card expiry date, and the cardholder’s name on the business’s website.

Given the sensitivity of such data and consumer privacy concerns in the other surveys, sharing this information with companies may prove a significant worry and potential barrier to uptake. Yet, quite a different picture was observed.

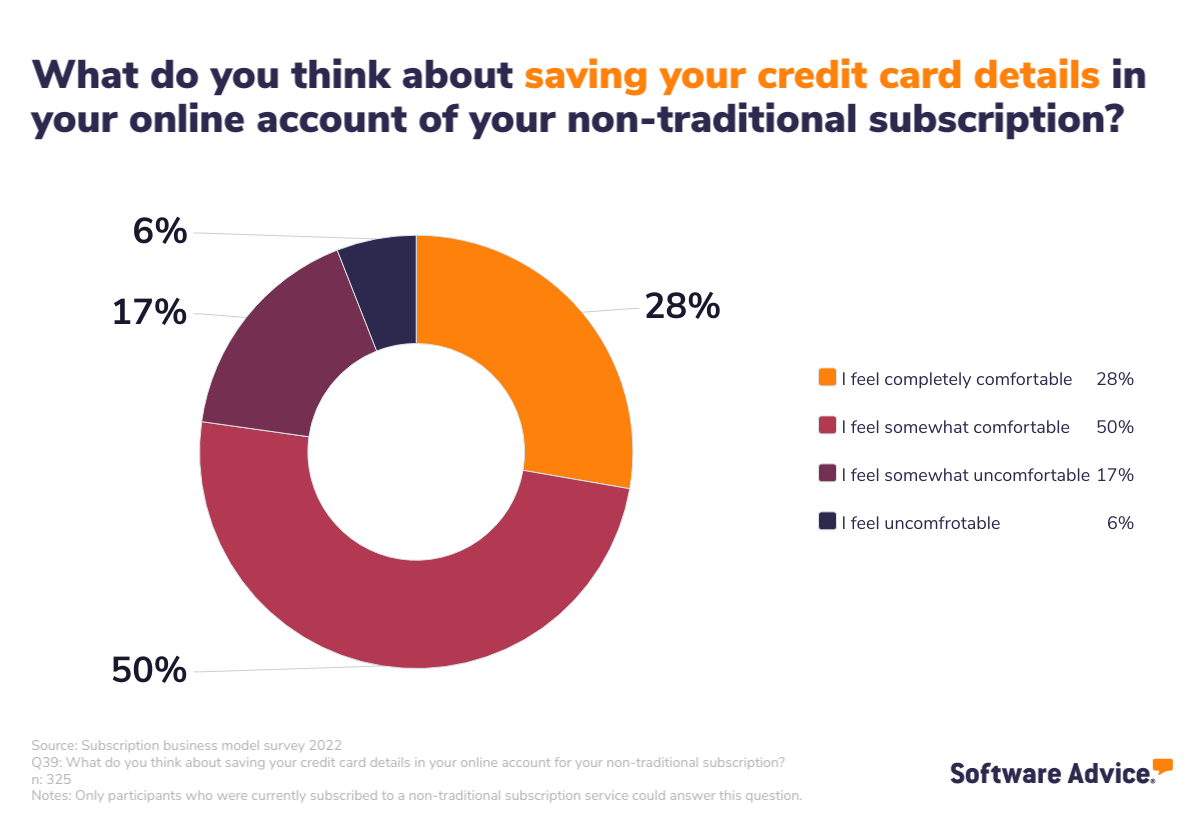

Instead, around three-quarters of the sample said they felt somewhat or entirely comfortable saving their credit card details on subscription company websites.

However, when the study pressed further and asked the 21% of respondents who expressed discomfort at saving their credit card data, security issues were the leading cause of their unease. 79% chose this as a reason, whilst 66% expressed concerns about data protection issues.

Like in the 2022 Checkoutless Shopping Survey, a group representing about a fifth of those signed up to non-traditional subscriptions expresses the highest concern when sharing sensitive information with companies. Furthermore, it was interesting to see proof that worries about security and data protection were behind this sentiment.

Key takeaway

The key takeaway from these findings is that businesses must demonstrate their compliance and commitment to data security and protection to avoid losing customers. Whilst most consumers will comfortably share their data, including credit card information, it is easy to alienate those unfamiliar or unsure of your security provisions.

Tip for SMEs

Reassure customers of your security credentials by clearly displaying relevant and trusted security certificates. Additionally, encryption software can help to protect and secure data by making it harder for unauthorised individuals to hack and access sensitive information stored on your database.

3. Most consumers are willing to share data, but with conditions

The COVID-19 pandemic caused a great deal of upheaval in all walks of life and led to huge increases in digitisation. Programs such as the NHS COVID pass and postal PCR testing led to more sensitive health and biometric data than ever being stored on company and institutional databases.

To study these effects, the 2022 COVID Monitoring Survey investigated how the UK’s online consumers interacted with companies and government bodies tracking COVID-19 outbreaks. The study also examined how respondents felt about sharing highly personal data and the ways it was later used.

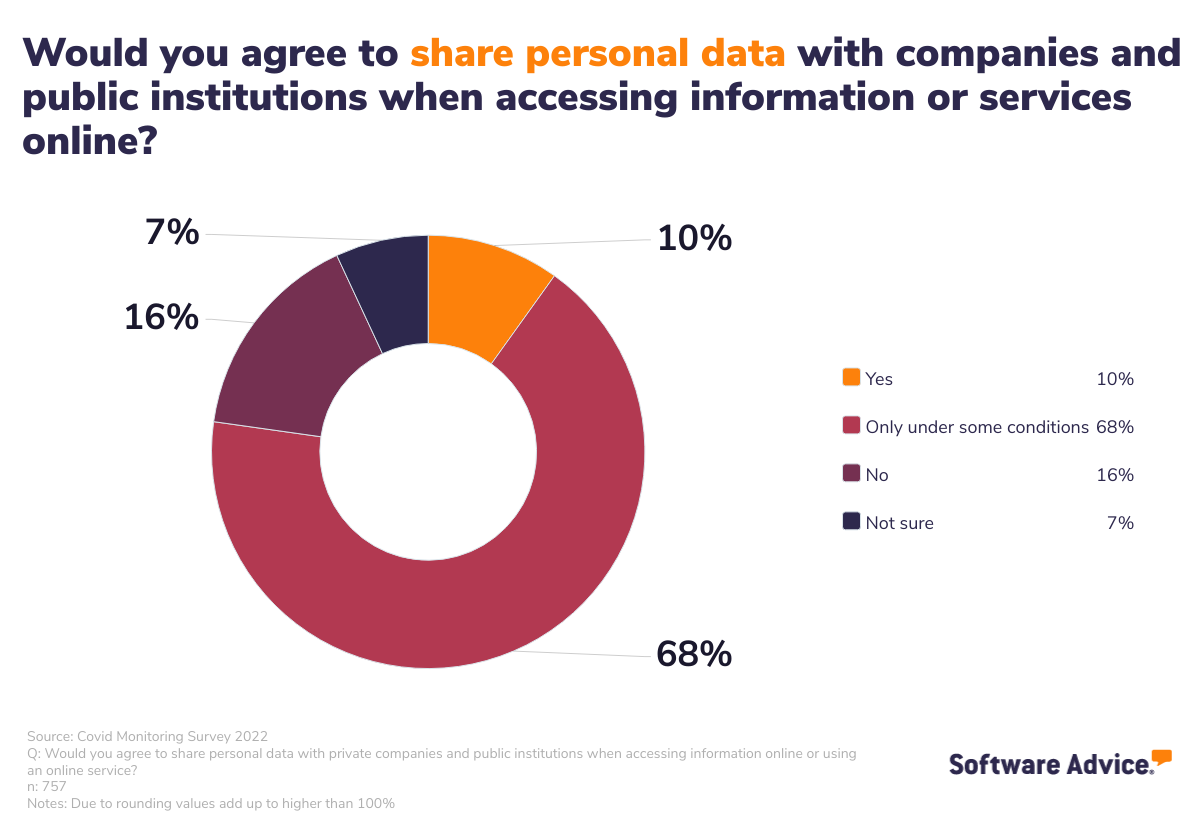

Like in other surveys many in the sample were broadly comfortable sharing sensitive data, albeit under specific circumstances. There was, however, a noticeable group that did not feel at ease to do so.

As before, a group representing around a fifth of survey respondents were uncomfortable or unsure about sharing their data with bigger entities. However, in this case, this quantity was observed amongst a more generalised survey sample rather than just in the prospective or current user base of a product or service.

As 68% said they would only share their data ‘under certain conditions’, the study sought to investigate these findings further. This group were asked for their top three conditions for sharing personal information.

The most commonly chosen condition was that there should be a statement explaining the data’s use. The following most-selected answer was there should be a statement describing precisely what data would be collected.

These two stipulations are covered by data protection legislation in the UK. The General Data Protection Regulation (GDPR) states that users must see and consent to information explaining the collected data and how it will be used. Therefore these would automatically be provided to users by companies to remain compliant with British consumer privacy laws.

However, the conditions that would stop people from agreeing to share their personal data required further investigation. The following infographic shows the reasons that the 10% of respondents who had said they would share their data would refuse their consent.

Nearly a third of the group wouldn’t agree to share data if a company required them to hand over too much personal information. This demonstrates that the relevance of the personal information used in data collection and privacy is vital, as consumers want to see that information is being taken to serve a legitimate purpose.

Additionally, a quarter said they wouldn’t provide data if they didn’t trust the collection entity.

Key takeaway

The first takeaway from these results is that users of their services are willing to share data as long as they are informed and assured about its use. Secondly, it can also be seen again that trust is paramount to this process.

This broadly reflects the findings seen before in this review of 2022. Again there was a group of around 10-20% who would not willingly share their data. However, the transparency, security, and relevance of shared data was vital amongst those that would.

Tip for SMEs

GDPR compliance software can assist companies in identifying the data that needs the most protection and ensure it is handled with the proper security protocols. By following the correct compliance procedures, businesses can gain sufficient trust to assure consumers their data will be appropriately handled.

4. Consumers proactively check data privacy reputations

Throughout this review of consumer data trends, online privacy has been seen as a primary concern for customers online when they share personal information with companies and governments.

To focus on how consumers feel about data privacy, the 2022 Privacy-Focused Consumers Survey questioned online shoppers on the importance they placed on a company’s approach to the handling of data privacy.

A notable finding in this study was that approximately two-thirds of the sample said yes in answer to the question, ‘Do you research a company’s data privacy reputation before making an online purchase?’

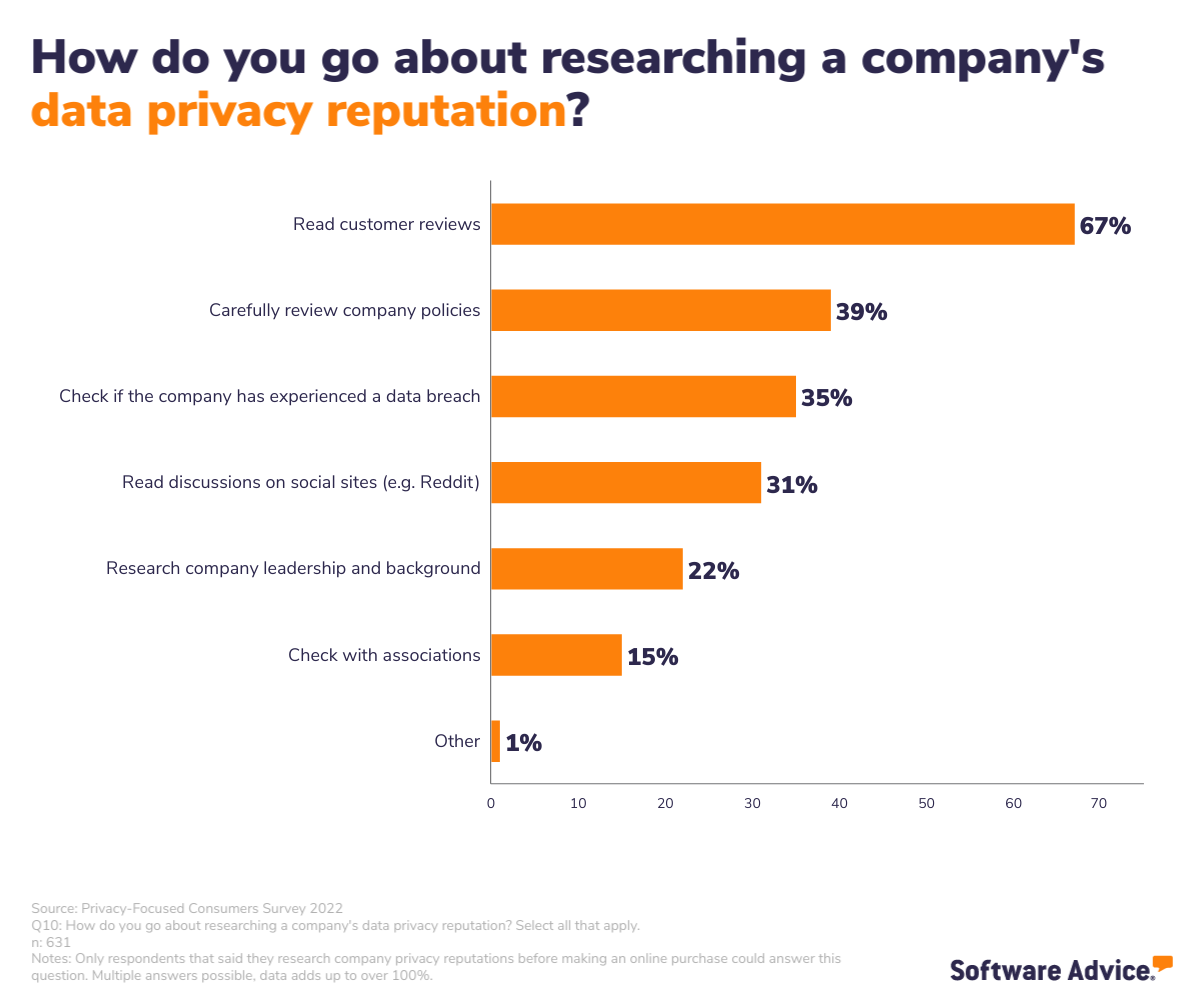

The survey then asked how those who reviewed company reputations performed these checks.

The most common way to do this was to read customer reviews. Another typical step that the participants noted was reading a company’s consumer privacy policy before making a purchase. As observed before, a transparent data governance strategy is crucial. Yet this should be clear and authentic in communicating this information to avoid suspicions of mispractice or misuse.

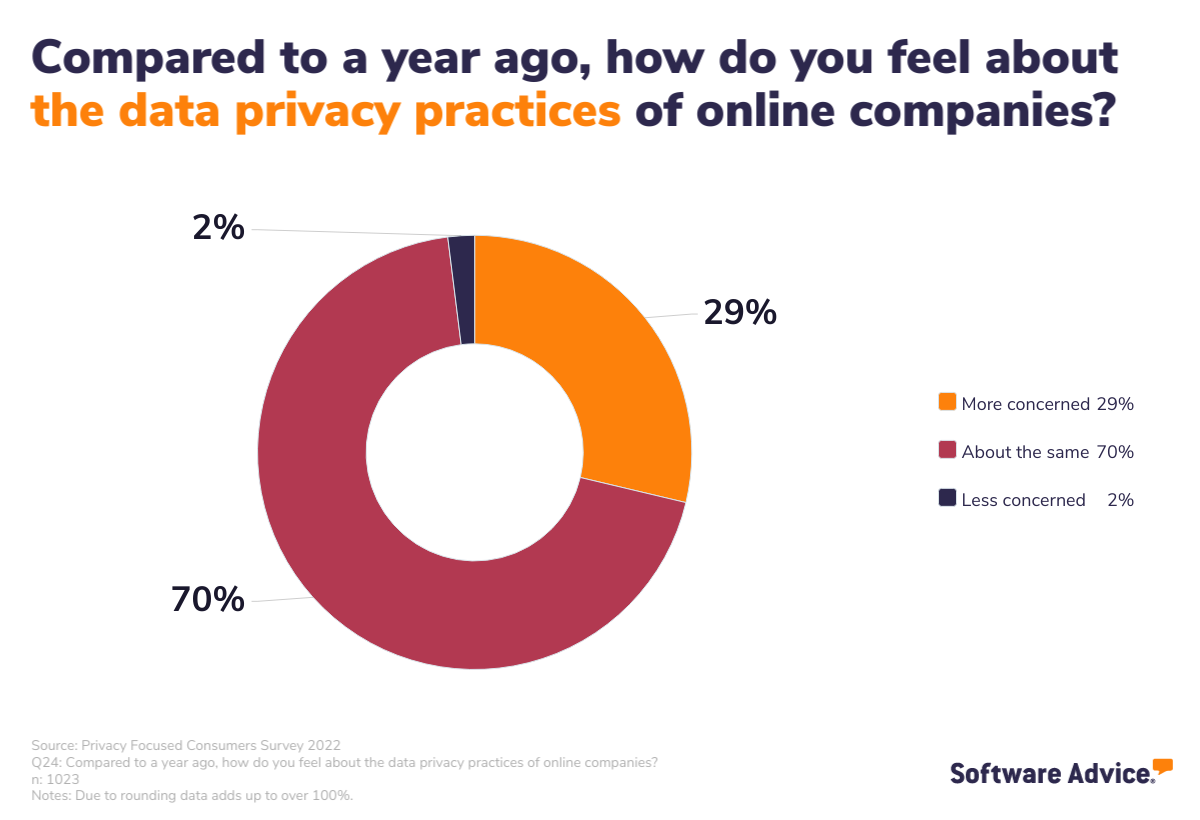

However, what did stand out from this particular study is that a large proportion of all respondents said they were more concerned about data privacy practices this year compared to last year.

With around a third of the sample expressing more concern versus only 2% who were less concerned, it was clear that worries had grown over the past year.

In many ways, this will have been driven by the digitisation observed during the COVID-19 pandemic. However, it shows that businesses, now more than ever, must be prepared to combat these growing concerns.

Key takeaway

Providing enough evidence to show consumers your brand can be trusted is a serious consideration to foster growth.

As seen in this data set, however, transparency and a clearly defined consumer privacy policy matter, as does collecting data that is relevant to the services being provided.

Tip for SMEs

A well-formulated and transparent data governance plan is crucial for showing customers that a business takes data protection seriously. Data governance software can help in this process to ensure businesses put security best practices in place and establish clear frameworks for collecting and using information.

What SMEs should do to create confident consumers

From analysing the data collected throughout the year, we’ve observed several clear trends about how consumers regard data privacy. From this, companies can take the following lessons:

- Transparency: Consumers are willing to give information but remain cautious and somewhat distrusting of companies. These worries can be counteracted by being transparent about the use of data and only asking for what is required of them to receive services from you.

- Integrity: There will usually be a clear group of consumers (the surveys indicated a rate of around 10%-20%) who will have the most concerns about data sharing. Build a trustworthy reputation by being authentic and clear in your communications, such as explaining why consumer privacy is important to your business and the steps taken to protect sensitive data that is collected.

- Purpose: The more sensitive the data, the higher the expectation of security provisions and the reluctance to share. This should be taken into account when creating a data governance strategy to build the most consumer trust possible.

As always, it is crucial consumer privacy laws are properly followed at the bare minimum. However, as the findings over 2022 have demonstrated, many pain points can be reduced to reassure consumer data privacy concerns and help avoid losing out on business.

Methodology

This Software Advice Digital Consumer Trend article identifies 4 trends that result from a meta-analysis of multiple surveys commissioned by Software Advice and its affiliate companies.

This report includes data from online surveys conducted between January 2022 and October 2022. Each survey was sent to approximately 1,000 consumers. Participants are older than 18 and live in the UK. The results derived are representative of the participants who took the survey, not the entire country/region.

Participant selection criteria for each of the surveys used for this report are as follows:

- Checkoutless Shopping Survey 2022: To conduct this report, 999 participants were surveyed in April 2022. Participants physically shop at least once a month, live in urban or suburban areas, have a smartphone, and understand the concept of checkout-free or cashier-less shopping.

- Subscription Business Model Survey 2022: To conduct this report, we surveyed 1,011 participants in August 2022. Participants shop online, sometimes, often, or very often, and know what traditional and non-traditional subscription models are.

- Covid Monitoring Survey 2022: To conduct this report, 757 participants were surveyed in February 2022. Participants purchase products via e-commerce and/or have hired services from an online platform and/or have used an application to make a purchase or hire a service and/or have created or used an account using their personal data on a social network and/or have done some online banking. They know what biometric methods are.

- Privacy-focused Consumers Survey 2022: To conduct this report, 1,023 participants were surveyed in July 2022. Participants shop online at least once per month.

This article may refer to products, programs or services that are not available in your country, or that may be restricted under the laws or regulations of your country. We suggest that you consult the software provider directly for information regarding product availability and compliance with local laws.